Little Known Facts About Custom Private Equity Asset Managers.

Wiki Article

Custom Private Equity Asset Managers Can Be Fun For Everyone

In Europe - a much more fragmented market - the connection between buyout funds and public equity is much reduced in the exact same period, sometimes unfavorable. Considering that private equity funds have much much more control in the business that they buy, they can make more energetic decisions to respond to market cycles, whether coming close to a boom period or an economic crisis.

In the sub-section 'Exactly how private equity influences portfolio returns' over, we saw just how including personal equity in a sample portfolio increased the overall return while likewise increasing the general danger. That said, if we check out the same kind of instance put differently, we can see that consisting of exclusive equity raises the return disproportionately to raising the danger.

The conventional 60/40 profile of equity and set income assets had a danger degree of 9. 4%, over a return of 8.

Our Custom Private Equity Asset Managers Diaries

By consisting of an allocation to private equity, the sample portfolio risk increased to 11. 1% - but the return likewise enhanced to the same figure. This is just an example based on an academic profile, however it reveals exactly how it is possible to use personal equity appropriation to branch out a portfolio and permit for greater inflection of danger and return.

Moonfare does not supply investment guidance. You must not understand any type of info or other material provided as lawful, tax obligation, financial investment, economic, or various other recommendations.

A link to this file will certainly be sent out to the complying with email address: If you would such as to send this to a various email address, Please click here Click on the link again. Private Equity Platform Investment.

10 Easy Facts About Custom Private Equity Asset Managers Explained

Investors are no longer running the service. Agents (in this case, managers) might make decisions that profit themselves, and not their principals (in this instance, proprietors).

The firm survives, however it becomes puffed up and sclerotic. The sources it is usinglabor, capital and physical stuffcould be used better someplace else, but they are stuck because of inertia and some residual a good reputation.

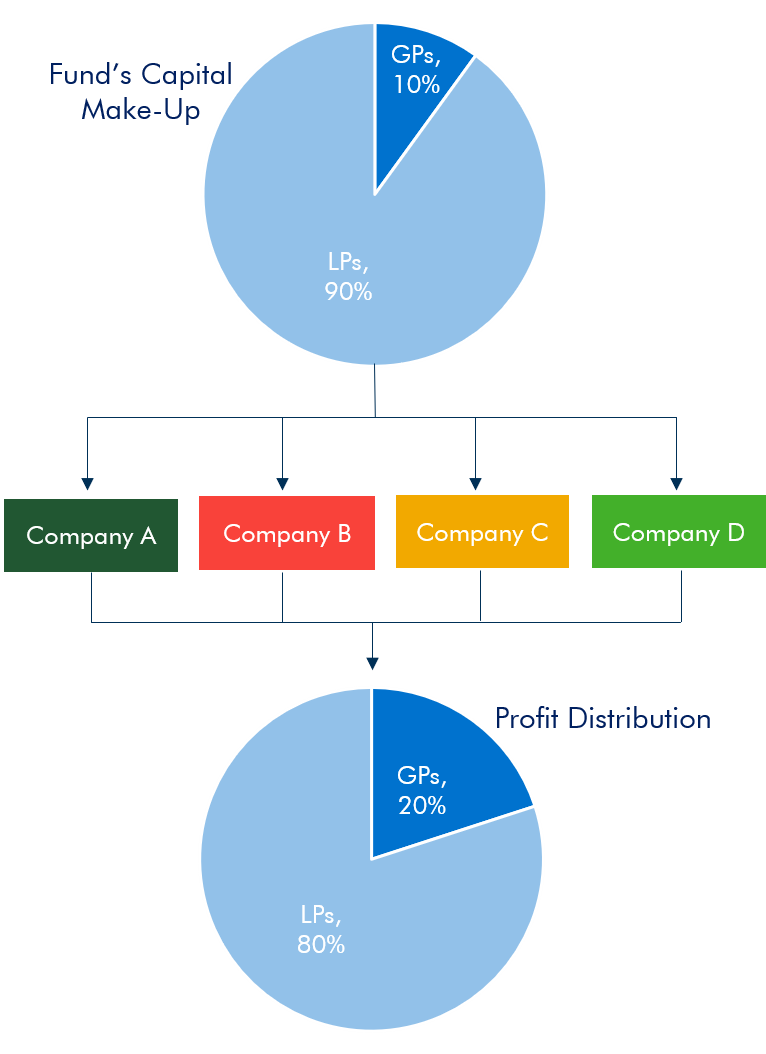

In the typical personal equity financial investment, a financial investment fund makes use of money elevated from rich individuals, pension funds and endowments of universities and charities to acquire the firm. The fund borrows money from a bank, making use of the assets of the company as collateral. It takes over the equity from the distributed investors, returning the firm to the area where it was when it was foundedmanagers as proprietors, rather than representatives.

Facts About Custom Private Equity Asset Managers Revealed

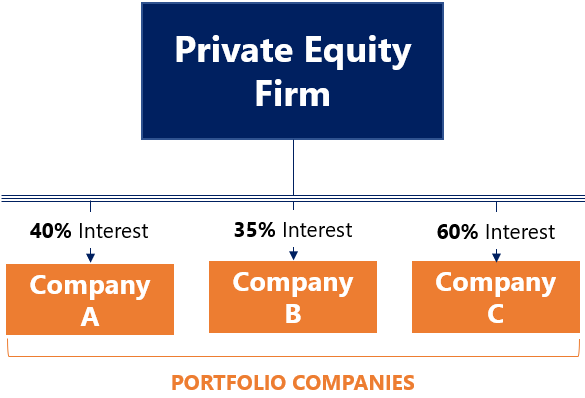

The personal equity fund installs management with sometimes that stake. CEOs of private equity-funded companies routinely obtain five percent of the company, with the administration team owning as long as 15 percent. The fund possesses all the rest. Once more, the ton of money of the business are connected with the ton of money of the supervisors.

This way, the value of exclusive equity is an iceberg. Minority companies that are taken exclusive every year, and the excess returns they make, are the bit above the water: huge and vital, however rarely the entire story. The gigantic mass listed below the surface is the companies that have far better monitoring since of the risk of being taken over (and the administration ousted and replaced by personal equity executives).

This holds true and is likewise taking place. It isn't sufficient. Companies aresometimes most efficient when they are exclusive, and often when they are public. All business begin exclusive, and numerous expand to the factor where marketing shares to the public makes good sense, as it allows them to reduce their price of resources.

Facts About Custom Private Equity Asset Managers Revealed

Private equity funds provide an indispensable solution by completing markets and letting firms maximize their value in all states of the globe. While personal equity-backed companies outperform their personal market competitors and, researches show, perform far better on worker safety and various other non-monetary dimensions, occasionally they take on as well much financial obligation and die.

Bad guys in service motion pictures are typically investment kinds, in contrast to home builders of things. Before he was redeemed by the woman of the street with the heart of gold, Richard Gere's character in Pretty Woman was an exclusive equity guy. He made a decision to build watercrafts, instead of buying and damaging up business.

navigate hereAmerican society dedicates substantial sources to the private equity industry, however the return is paid back many-fold by increasing the performance of every company. All of us gain from that. M. Todd Henderson is professor of law at the College of Chicago Law Institution. The sights revealed in this short article are the author's own.

Things about Custom Private Equity Asset Managers

Newsweek is committed to difficult traditional wisdom and searching for connections in the search for commonalities. Private Equity Platform Investment.

We find a systematic, constant picture of people doing worse after the nursing home is bought by exclusive equity. Werner directed out that researches of nursing homes throughout the COVID-19 pandemic found that exclusive equity-managed organizations made out better than taking care of homes that weren't included in private equity at the time.

Report this wiki page